LaFMS is aligned with the upcoming Fiscalization 2.0.

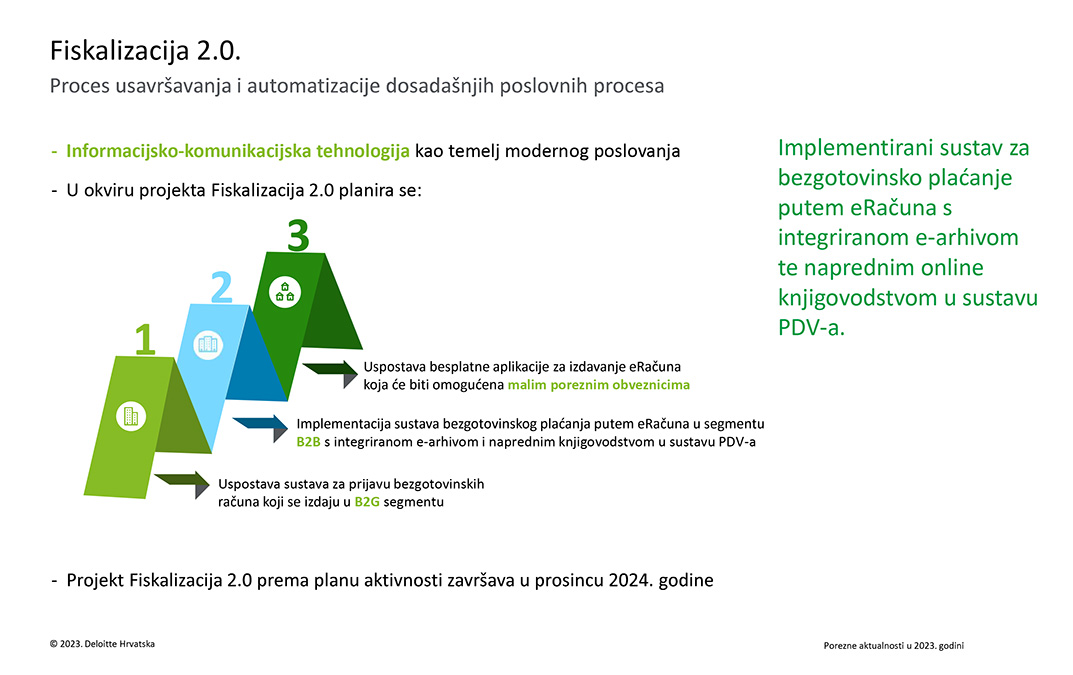

The Ministry of Finance, Tax Administration is the project holder Fiscalization 2.0 - Implementation of a system for non-cash payments via eInvoices with integrated e-archive and advanced online accounting in the VAT system.

The Fiscalization 2.0 project, according to the activity plan, will end in December 2024, and its final product is an implemented system for non-cash payments via eInvoices with integrated e-archive and advanced online accounting in the VAT system.

In the future, a digital archive will be inevitable. The Tax Administration will have information in real time. When an outgoing invoice is created and after confirmation, the Tax Administration will immediately know what the VAT obligation is. The same is true for suppliers, so it will be known who has a VAT obligation or overpayment.

The implementation extends to all segments of business cooperation between different stakeholders, regardless of whether it is cooperation between business entities themselves or business cooperation with public bodies. In short, digital archives will be a must for B2B as well.

LaFMS – A SYSTEM THAT PROVIDES DIGITAL ARCHIVES

From Poslovni dnevnik, Iva Grković:

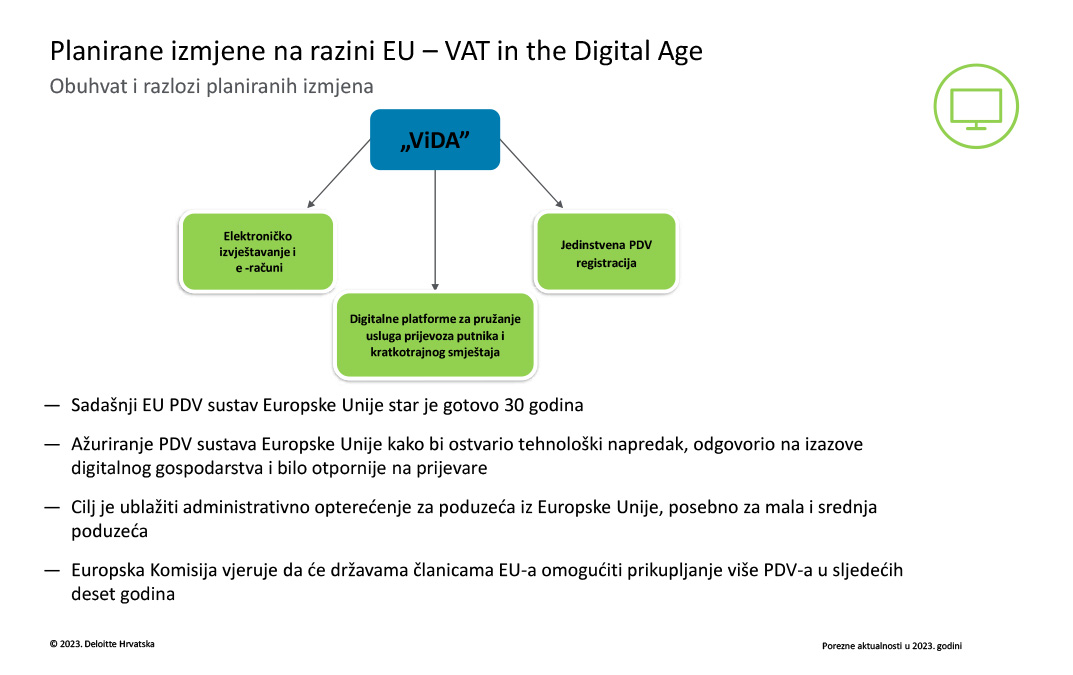

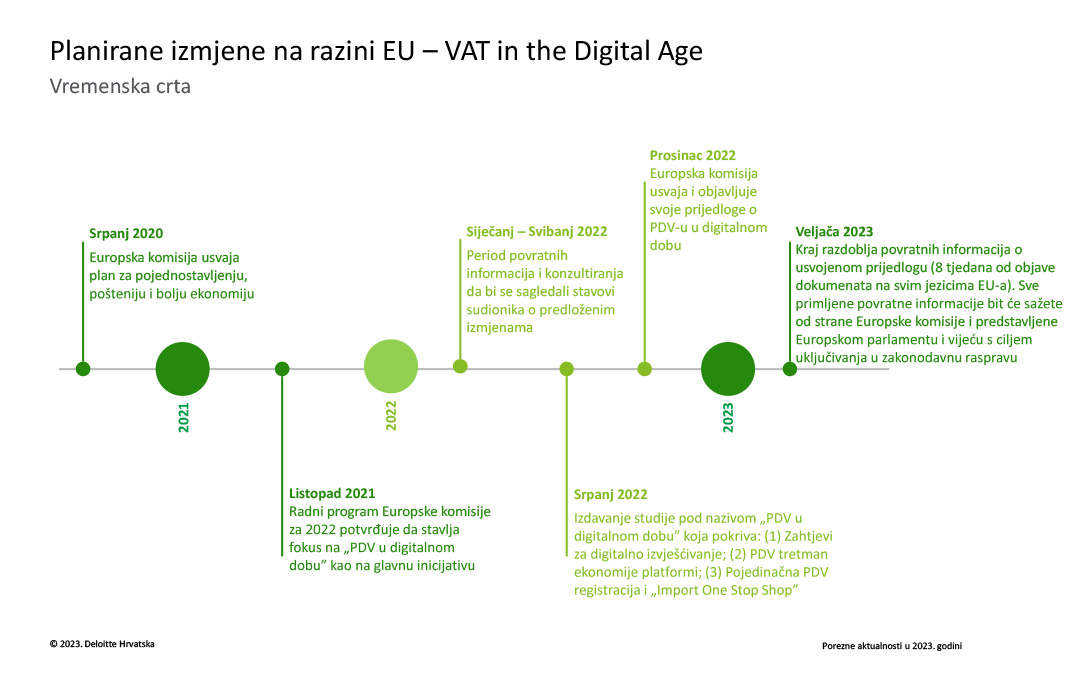

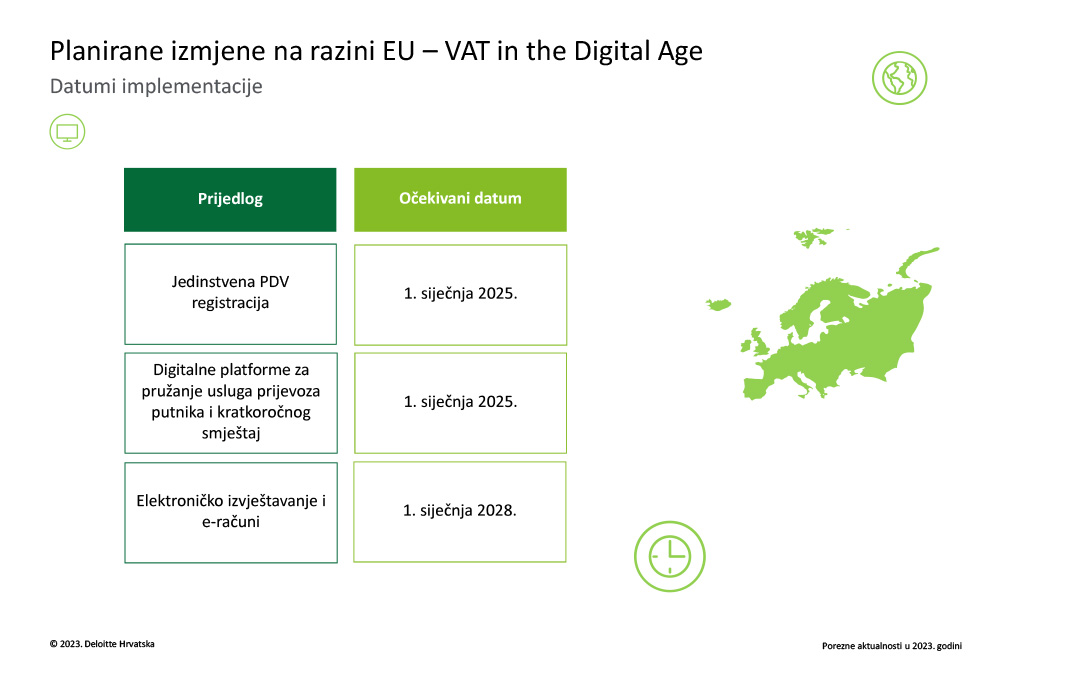

I must also emphasize the importance of our LaFMS, with which our users are already one step ahead. Research shows that 60% of companies on the market practice "remote" work, and in light of such a way of working, digital archives, digital document management and their verification are of great importance for every company, regardless of size. In addition, we are also facing planned changes at the EU level, such as "ViDA" (VAT in the Digital Age), for which LaFMS is ready.

Project Goal Fiscalization 2.0. is the establishment of a system for fiscalizing invoices issued in the economy (B2B) with the implementation of a cashless payment system via e-Invoice with an integrated e-archive and active, unique and advanced online accounting in the VAT system in order to ensure a whole range of benefits for all stakeholders and business entities:

-

facilitated tax returns

-

reduction in the number of required forms (tax accounting), accuracy in fulfilling tax obligations and to a significant extent their pre-fulfillment with data from the e-Invoice platform

-

transparent business operations and the possibility of insight into payment deadlines and compliance with payment deadlines

-

insight into the current business operations of an individual taxpayer

-

current creditworthiness checks

-

contribution to environmental protection by using a digital instead of a "paper" invoice archive

-

reduction in the number of invoice copies and their archiving via an Internet intermediary

-

possibility of sending invoice attachments and relieving the burden of paperwork

-

improvement of interoperability between actors involved in the collection process

-

possibility of monitoring and linking invoices and prevention of tax fraud related to VAT refunds

-

business entities receive support for more efficient and competitive business in the national and global context.

-

Within the framework of the Fiscalization 2.0 project, it is planned (Delloite Croatia, 2023):

Within the framework of the Fiscalization 2.0 project, it is planned (Delloite Croatia, 2023):

Contact us and find out how you can transform your business.